Solana vs Ethereum: The Latest Comprehensive Analysis

Solana and Ethereum employ fundamentally different approaches to blockchain technology, each with its own strengths and limitations.

Solana and Ethereum stand as two titans in the blockchain arena, each offering unique advantages in the rapidly evolving world of decentralized finance and smart contracts. As reported by Forbes, industry experts anticipate Solana could reach a price target of $200 by late 2024, potentially outperforming Ethereum. This introduction explores the key differences, strengths, and potential trajectories of these blockchain giants, examining their technological capabilities, ecosystem growth, and investment potential in the context of the ongoing debate over which platform will ultimately dominate the smart contract landscape.

Technological Capabilities Comparison

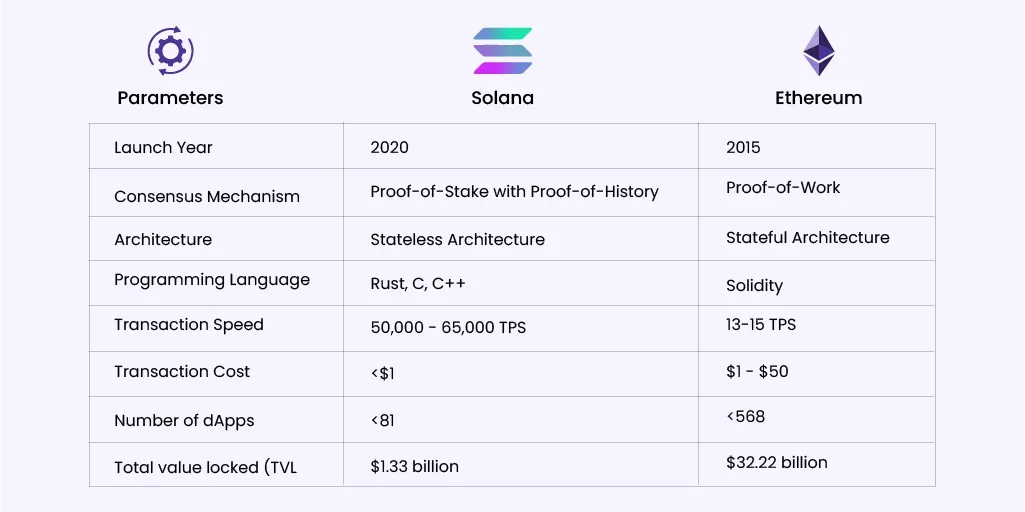

Solana and Ethereum employ fundamentally different approaches to blockchain technology, each with its own strengths and limitations. Ethereum utilizes a Proof of Stake (PoS) consensus mechanism after transitioning from Proof of Work in 2022. This shift aimed to improve scalability and reduce energy consumption. Solana, on the other hand, combines Proof of Stake with a unique Proof of History (PoH) consensus, allowing for high throughput without compromising decentralization or security.

Solana's architecture enables parallel processing capabilities, supporting high-speed decentralized applications (dApps). This parallel processing, coupled with the PoH mechanism, contributes to Solana's ability to handle up to 65,000 transactions per second (TPS), significantly outpacing Ethereum's 15-30 TPS. However, it's important to note that Solana's actual transaction speed in practice is often lower than its theoretical maximum, with some sources reporting around 2,600 TPS.

Ethereum's strength lies in its robust smart contract capabilities and extensive dApp ecosystem. It pioneered smart contract technology and has a more mature development environment, with languages like Solidity and Vyper specifically designed for Ethereum development. Solana, while newer, offers a different approach to smart contract development, primarily using Rust, which may appeal to developers familiar with systems programming.

In terms of network stability, Ethereum has proven more reliable over time. Solana has faced challenges with network outages, which have raised concerns about its long-term stability. These outages, while rare, have been more frequent than those experienced by Ethereum, potentially impacting user and developer confidence.

Both platforms are actively working on scalability solutions. Ethereum is developing layer-2 solutions and sharding to improve its transaction capacity and reduce fees. Solana, already boasting high throughput, is focusing on enhancing network stability and expanding its ecosystem.

The choice between Solana and Ethereum often comes down to the specific needs of a project or application. Ethereum's mature ecosystem and proven track record make it a safer choice for many developers and investors. However, Solana's high-speed, low-cost transactions offer compelling advantages for applications requiring frequent, rapid interactions, such as decentralized exchanges or gaming platforms.

As the blockchain space continues to evolve, both Solana and Ethereum are likely to play significant roles, each carving out its niche based on its unique technological capabilities and ecosystem strengths.

Performance Metrics Analysis

When comparing Solana and Ethereum, several key performance metrics stand out:

Transaction Speed and Throughput:

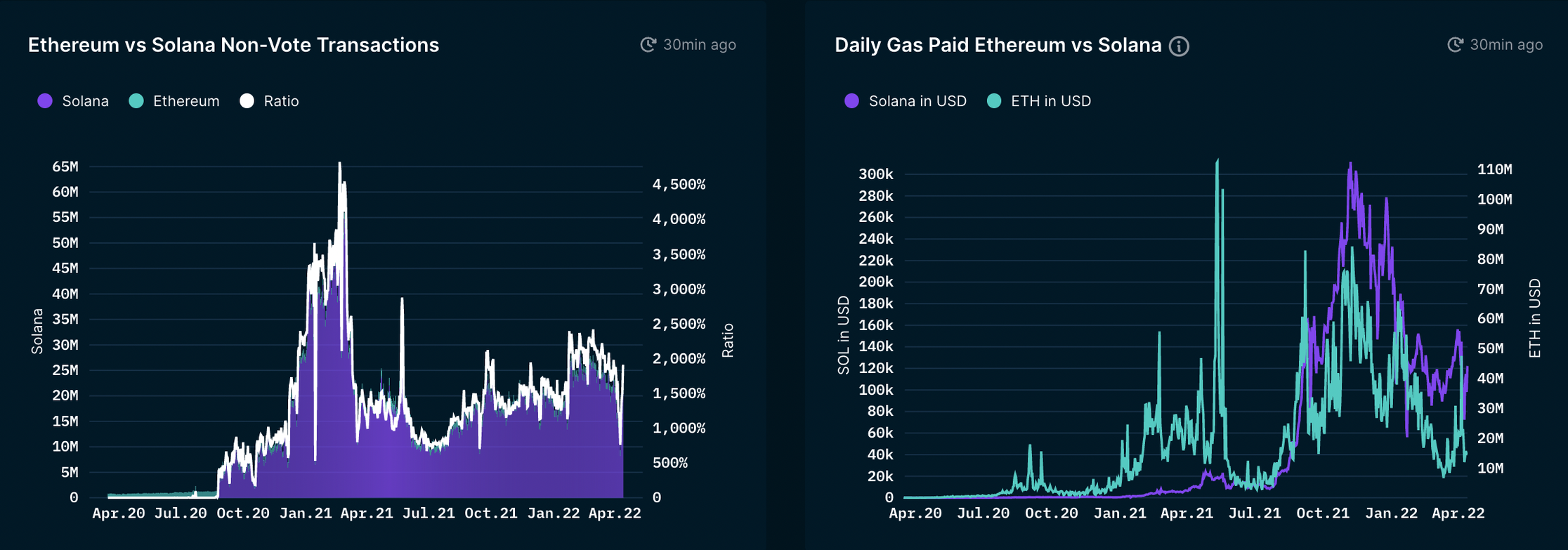

Solana significantly outperforms Ethereum in terms of transaction speed. Solana can theoretically process up to 65,000 transactions per second (TPS), though real-world performance is typically around 2,600 TPS. In contrast, Ethereum's current capacity is limited to 15-45 TPS. This vast difference in throughput gives Solana a clear advantage for applications requiring high-frequency transactions.

Transaction Costs:

Solana's transaction fees are consistently low, typically around $0.00025 per transaction. Ethereum's gas fees are much higher and more volatile, ranging from $1 to $50 or more during network congestion. This cost difference makes Solana more attractive for micro-transactions and frequent network interactions.

Scalability:

Solana's architecture is designed for better scalability. Its unique Proof of History (PoH) consensus mechanism, combined with Proof of Stake (PoS), allows for parallel processing of transactions. Ethereum is working on improving scalability through its transition to Ethereum 2.0 and layer-2 solutions, but currently lags behind Solana in this aspect.

Network Stability:

Ethereum has demonstrated superior network stability over time. While Solana offers impressive performance metrics, it has faced several network outages, raising concerns about its long-term reliability. Ethereum's more established infrastructure has proven more resilient to disruptions.

Developer Adoption:

Ethereum leads in terms of developer adoption and ecosystem size. It has a larger number of active developers and deployed projects. However, Solana is rapidly gaining traction, with its developer-friendly environment and support for popular programming languages like Rust attracting new talent.

Total Value Locked (TVL):

Ethereum dominates in terms of TVL, with a significantly larger amount of assets locked in its DeFi protocols compared to Solana. This indicates a higher level of trust and adoption in Ethereum's DeFi ecosystem.

Energy Efficiency:

Both networks now use Proof of Stake, but Solana's unique consensus mechanism makes it more energy-efficient than Ethereum. This could be an important factor for environmentally conscious investors and users.

Market Performance:

In recent times, Solana has shown impressive market performance, outpacing Ethereum in terms of price appreciation. SOL has gained around 400% more than ETH in the past year. However, Ethereum's market capitalization remains significantly larger, indicating its dominant position in the market.

These performance metrics highlight Solana's strengths in speed, cost-efficiency, and scalability, while Ethereum maintains advantages in network stability, ecosystem size, and overall market dominance. The choice between the two often depends on specific use case requirements and risk tolerance.

Investment Pros and Cons

When considering Solana and Ethereum as investment options, it's crucial to weigh the pros and cons of each platform:

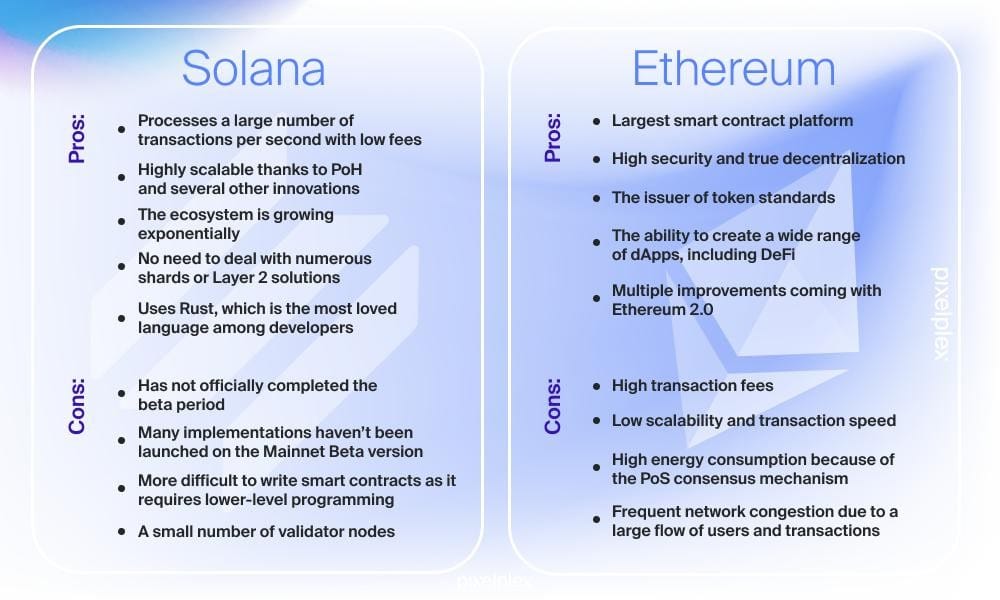

Solana (SOL) Pros:

- High-speed transactions: Solana's ability to process up to 65,000 TPS theoretically (though practically around 2,600 TPS) makes it attractive for applications requiring rapid transactions.

- Low transaction costs: With fees as low as $0.00025 per transaction, Solana is ideal for micro-transactions and frequent network interactions.

- Strong growth potential: Solana has shown impressive market performance, gaining around 400% more than ETH in the past year.

- Energy efficiency: Solana's unique consensus mechanism makes it more energy-efficient than many competitors.

Solana (SOL) Cons:

- Network stability issues: Solana has faced several network outages, raising concerns about long-term reliability.

- Relative immaturity: As a newer platform, Solana has a shorter track record compared to Ethereum.

- Centralization concerns: Critics have raised issues about Solana's perceived centralization due to the high cost of setting up a node.

Ethereum (ETH) Pros:

- Established ecosystem: Ethereum boasts a vast and mature ecosystem of dApps and DeFi protocols.

- First-mover advantage: As the pioneer of smart contracts, Ethereum has a strong brand and developer community.

- Network stability: Ethereum has demonstrated superior long-term reliability compared to Solana.

- Ongoing improvements: The transition to Ethereum 2.0 and layer-2 solutions aim to address scalability and efficiency issues.

Ethereum (ETH) Cons:

- Higher transaction costs: Ethereum's gas fees can be prohibitively expensive during network congestion.

- Slower transaction speeds: With 15-45 TPS, Ethereum lags behind Solana in transaction throughput.

- Scalability challenges: Despite ongoing upgrades, Ethereum still faces scalability issues that could limit its growth.

Investment Outlook:

Some experts predict Solana could outperform Ethereum by 500% in the next bull run. The SOL/ETH ratio is expected to rise from the current 0.14 to potentially 0.76, suggesting significant outperformance potential for Solana. However, Ethereum's larger market cap ($360 billion vs. Solana's $60 billion) indicates its dominant position and potential stability.

Both platforms present unique investment opportunities. Solana offers higher growth potential but with increased risk due to its relative immaturity and stability concerns. Ethereum provides a more stable investment with steady growth potential, backed by its established ecosystem and ongoing improvements.

Investors should consider their risk tolerance, investment horizon, and belief in each platform's technological and market potential. As with any cryptocurrency investment, thorough research and consultation with a financial advisor are recommended due to the market's volatility and regulatory uncertainties.

Solana vs. Ethereum Outlook

The outlook for Solana and Ethereum is shaped by their current trajectories, ongoing developments, and potential future impacts on the blockchain ecosystem:

Solana's Growth Potential:

Solana has demonstrated impressive growth, with its native token SOL outperforming Ethereum's ETH by a wide margin in recent times. Industry experts anticipate Solana could reach a price target of $200 by late 2024, potentially exceeding $300 by 2025. This optimistic projection is supported by Solana's increasing adoption in decentralized finance (DeFi) and non-fungible token (NFT) sectors.

Solana's future looks promising due to several factors:

- Technological advancements: The upcoming Firedancer upgrade could further enhance Solana's performance, potentially making it even faster and more appealing to institutional investors.

- Growing ecosystem: Solana's developer-friendly environment and support for popular programming languages like Rust are attracting new talent and projects.

- Market sentiment: The broader market sentiment plays a role in Solana's bullish trajectory, with expectations of altcoins following Bitcoin's upward trend.

However, Solana faces challenges:

- Network stability: Past outages have raised concerns about long-term reliability.

- Centralization criticisms: Some argue that Solana could do more to increase the number of participating validators and further decentralize its base layer.

Ethereum's Continued Dominance:

Despite Solana's rapid growth, Ethereum maintains its position as the most valuable smart contract blockchain in the world, partly due to its first-mover advantage. Ethereum's outlook is characterized by:

- Ecosystem maturity: Ethereum boasts a vast and well-established ecosystem of dApps and DeFi protocols.

- Ongoing improvements: The transition to Ethereum 2.0 and layer-2 scaling solutions aim to address scalability and efficiency issues.

- Developer mindshare: Ethereum continues to lead in terms of developer adoption and deployed projects.

Ethereum's challenges include:

- Scalability issues: Despite upgrades, Ethereum still faces scalability challenges that could limit its growth.

- High transaction costs: Gas fees remain a concern, especially during network congestion.

Comparative Outlook:

While some experts foresee Solana outperforming Ethereum by 500% in the next bull run, others believe both platforms will coexist, each carving out its niche based on unique strengths. The SOL/ETH ratio is expected to rise, potentially reaching 0.76 from the current 0.14, suggesting significant outperformance potential for Solana.

However, Ethereum's larger market cap ($360 billion vs. Solana's $60 billion) indicates its dominant position and potential stability. Ethereum's focus on technological change and security contrasts with Solana's active marketing approach, affecting their respective volatilities and investor perceptions.

Future Relationship:

The future relationship between Solana and Ethereum is likely to be characterized by both competition and complementarity. While Solana may continue to gain market share in areas requiring high-speed, low-cost transactions, Ethereum's established ecosystem and ongoing improvements may help it maintain its leadership position in the broader blockchain space.

Investors and developers will likely continue to evaluate both platforms based on their specific needs, risk tolerance, and belief in each platform's long-term potential. As the blockchain industry evolves, both Solana and Ethereum are poised to play significant roles, potentially driving innovation and adoption in different segments of the market.