GameStop Stock Surges as 'Roaring Kitty' Sparks New Meme Stock Frenzy

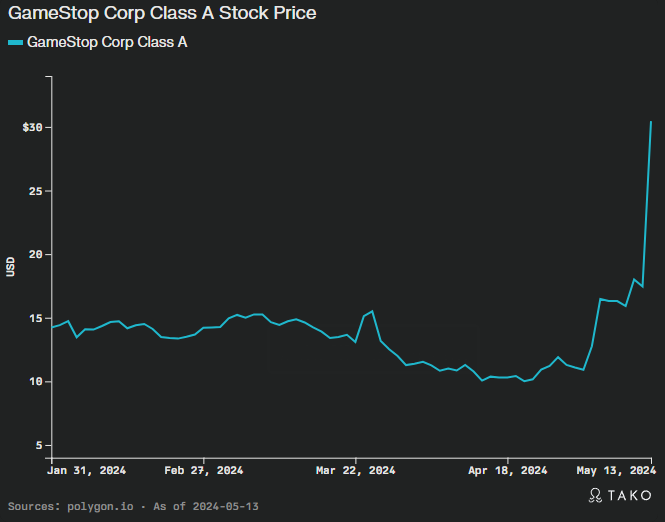

GameStop (NYSE:GME) stock skyrocketed as much as 110% on Monday, May 13, 2024, after the reemergence of Keith Gill, also known as "Roaring Kitty," reignited interest in the meme stock phenomenon 168. Gill, who played a pivotal role in the GameStop short squeeze of 2021, posted a meme on X (formerly Twitter) depicting a gamer sitting up in his chair, which sparked a trading frenzy reminiscent of the original meme stock rally 168.

GameStop Stock Price Soars

GameStop shares closed the day up 75% at $30.45, with trading halted multiple times due to volatility 8. The stock had been on an upward trajectory in the weeks leading up to Gill's post, gaining nearly 60% 8. The surge in price was driven by renewed interest from retail investors, who had previously banded together on Reddit's r/WallStreetBets forum to drive up the price of heavily shorted stocks like GameStop 168.

The GameStop short squeeze of 2021 saw the stock price reach an all-time intraday high of $483 per share on January 28, 2021, nearly 30 times its valuation at the beginning of that month 121314. However, the stock price quickly plummeted after several brokerages, including Robinhood, restricted buying of GameStop shares 1214.

Meme Stock Rally Spreads

The resurgence of interest in GameStop also sparked rallies in other meme stocks, such as AMC Entertainment (NYSE:AMC) and Beyond, Inc.18. AMC shares gained as much as 50%, while Beyond, Inc. saw an 8% increase8. The broader meme stock rally was fueled by a growing risk tolerance among retail investors and a desire to challenge the financial establishment8.

Short sellers have been hit hard by the recent GameStop rally, with losses totaling $1.34 billion in May and $952 million year-to-date, according to S3 Partners 8. Short interest in GameStop remains high at around 24% of the float 8.

GameStop's Fundamentals Remain Weak

Despite the recent surge in its stock price, GameStop's underlying business continues to face significant challenges 2371718. The company, which primarily operates brick-and-mortar video game stores, has struggled in recent years due to competition from digital distribution services and the economic impact of the COVID-19 pandemic 12.

GameStop reported a larger-than-expected loss in its fiscal third quarter of 2023 and has seen its revenue decline in recent years 212. Analysts remain skeptical about the company's long-term prospects, with many predicting further declines in revenue and questioning the viability of its business model 2371718.

Wedbush analyst Michael Pachter recently lowered his price target on GameStop stock, predicting that the company's demise is likely to occur later this decade 18. Pachter cited GameStop's lack of a clear strategy and the likelihood of continued revenue declines as reasons for his bearish outlook 18.

Ryan Cohen's Leadership and Turnaround Efforts

Supporters of GameStop stock point to the leadership of Ryan Cohen, the company's chairman and largest individual shareholder, as a reason for optimism 17. Cohen, who co-founded online pet retailer Chewy, has been working to transform GameStop's business model since joining the board in January 2021 1217.

Under Cohen's leadership, GameStop has focused on establishing omnichannel retail excellence, achieving profitability, and leveraging its brand equity for growth 17. The company has also strengthened its balance sheet and cash position, giving it a longer runway to execute its turnaround strategy 17.

However, even with Cohen at the helm, GameStop faces an uphill battle in adapting to the rapidly changing gaming industry 15161718. The company's core business of selling physical video games is becoming increasingly obsolete as more gamers shift to digital downloads and cloud gaming services 151618.

The Future of Meme Stocks

The resurgence of the GameStop rally has reignited discussions about the future of meme stocks and the role of retail investors in the stock market 8911. While some view the meme stock phenomenon as a democratization of investing, others caution that it can lead to excessive speculation and market instability 89.

The GameStop short squeeze of 2021 drew attention to the power of retail investors to challenge Wall Street institutions, but it also raised concerns about market manipulation and the potential for inexperienced investors to suffer significant losses 1214. The U.S. House Committee on Financial Services held a congressional hearing on the incident, and dozens of class action lawsuits were filed against Robinhood for its role in restricting trades 14.

As the meme stock trend continues, regulators and market participants will need to grapple with the implications of this new era of retail investing 911. While some see it as a positive development that empowers individual investors, others worry that it could lead to increased volatility and a disconnect between stock prices and underlying fundamentals 911.

Conclusion: Approach With Caution

The recent surge in GameStop stock, driven by the reemergence of "Roaring Kitty" and a renewed interest in meme stocks, has once again put the spotlight on the power of retail investors to move markets. However, the company's weak fundamentals and the challenges it faces in adapting to the changing gaming industry suggest that the current rally may not be sustainable in the long run.

As the meme stock phenomenon continues to evolve, investors, regulators, and market participants will need to carefully consider the implications of this new era of retail investing. While it has the potential to democratize access to the stock market, it also carries risks of excessive speculation and market instability.

For GameStop, the future remains uncertain. Despite the efforts of Ryan Cohen and the company's leadership to transform its business model, the structural headwinds facing the gaming industry may prove too difficult to overcome. As such, investors should approach GameStop stock with caution and carefully consider the risks and potential rewards before making any investment decisions.